Our Mission: Connecting Dallas Homebuyers with Trusted Mortgage Lenders

Oak Mortgage Group Directory was founded with a simple yet powerful mission: to help Dallas-area homebuyers find reputable, qualified mortgage lenders who can provide the financing they need to achieve their homeownership dreams. We understand that choosing a mortgage lender is one of the most important financial decisions you'll make, and navigating the crowded landscape of Dallas mortgage companies can be overwhelming. Our directory simplifies this process by curating a comprehensive list of established, trusted mortgage lenders serving the Dallas-Fort Worth metroplex.

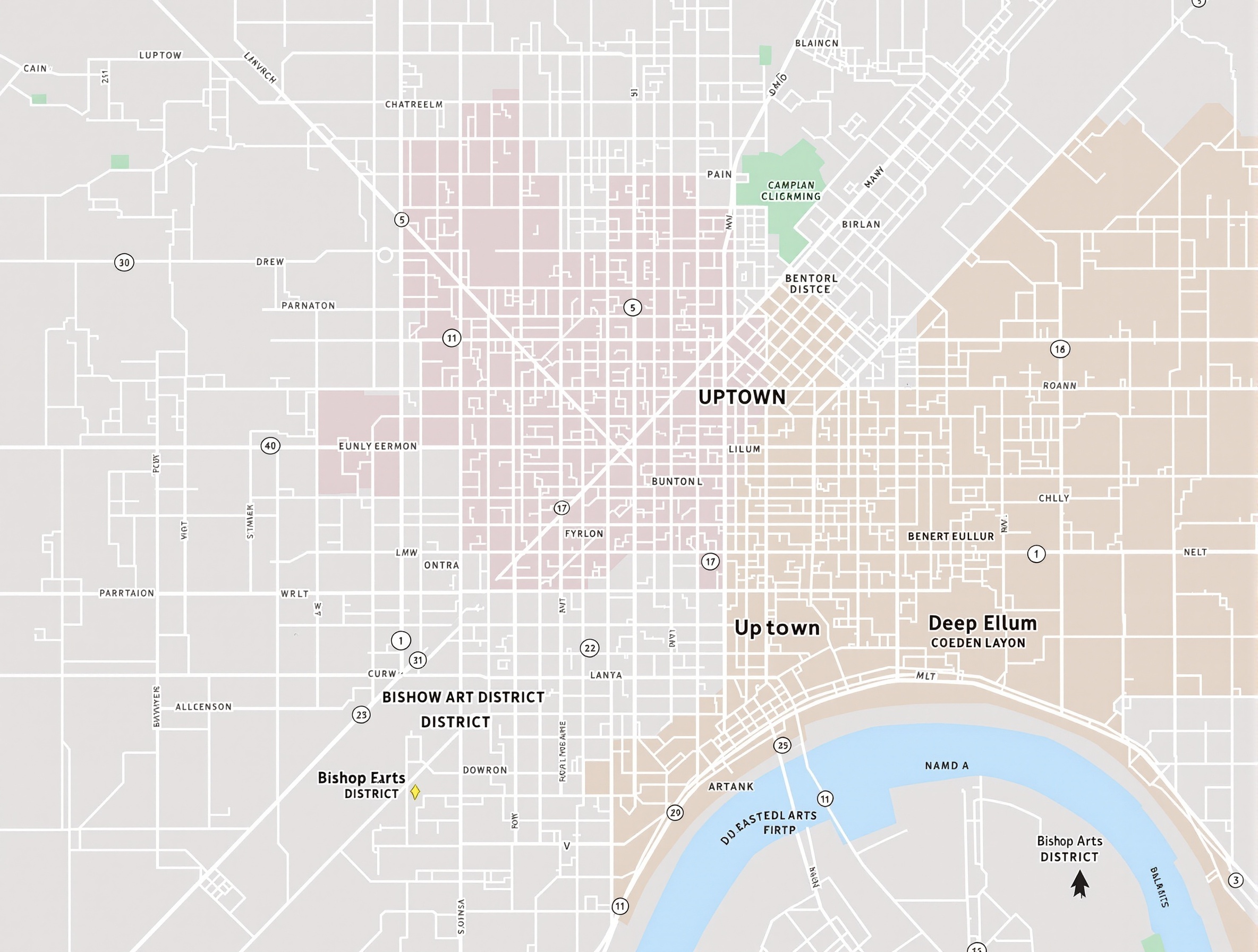

The Dallas real estate market is dynamic, competitive, and offers tremendous opportunities for homebuyers. Whether you're a first-time buyer exploring neighborhoods like Oak Cliff and Lake Highlands, a veteran seeking to use VA loan benefits, a growing family searching for homes in Richardson or Plano, or an affluent buyer pursuing luxury properties in Highland Park, finding the right mortgage lender is crucial to your success. Oak Mortgage Group Directory serves as your starting point, connecting you with lenders who specialize in your specific needs and can guide you through the mortgage process with expertise and professionalism.

Why Dallas Needs a Trusted Mortgage Directory

The Dallas-Fort Worth metroplex is one of America's fastest-growing regions, with thousands of new residents arriving monthly seeking career opportunities, quality of life, and affordable housing compared to coastal markets. This growth has created a thriving real estate market with median home prices around $375,000, strong appreciation, and diverse housing options from urban high-rises to suburban single-family homes.

With this growth comes an abundance of mortgage lenders—from large national banks to small local brokers, online lenders to credit unions. While options are beneficial, the sheer number of choices can overwhelm homebuyers, particularly first-time buyers unfamiliar with mortgage processes. Many Dallas residents spend weeks or months researching lenders, unsure whom to trust or how to compare options effectively.

Oak Mortgage Group Directory addresses this challenge by providing a curated resource featuring established Dallas mortgage companies with proven track records. We focus on lenders who demonstrate commitment to customer service, competitive pricing, ethical practices, and deep knowledge of the Dallas market. Our directory includes detailed information about each lender's specialties, loan products, contact information, and customer reviews, empowering you to make informed decisions about your mortgage financing.

What We Offer Dallas Homebuyers

Oak Mortgage Group Directory provides comprehensive resources designed to make your mortgage search efficient, informed, and successful. Our platform offers multiple benefits to Dallas-area homebuyers seeking financing.

Curated Lender Listings

We feature mortgage companies serving Dallas that meet our standards for professionalism, experience, and customer service. Our directory includes diverse lenders serving different borrower needs—from first-time buyer specialists to VA loan experts to jumbo loan providers for luxury properties. Each listing provides essential information including contact details, service areas, loan products offered, and specialties, allowing you to quickly identify lenders matching your needs.

Educational Content

Beyond lender listings, we provide extensive educational content helping Dallas homebuyers understand mortgage options, qualification requirements, current rate trends, and strategies for successful home purchases. Our guides cover topics including FHA loans, VA loans, first-time homebuyer programs, and current mortgage rates. This educational approach ensures you approach lenders with knowledge and confidence.

Local Market Expertise

We understand the Dallas market's unique characteristics—from high property taxes to neighborhood appreciation trends to local down payment assistance programs. Our content reflects this local expertise, providing relevant, actionable information specific to Dallas homebuyers rather than generic national content. We cover Dallas neighborhoods, market trends, and local programs that affect your home financing decisions.

Free Resource with No Hidden Agendas

Oak Mortgage Group Directory is a free resource for Dallas homebuyers. We don't charge fees for accessing lender information or educational content. Our goal is connecting you with quality lenders who can serve you well, not pushing you toward specific lenders based on referral fees or partnerships. You can explore our directory, compare lenders, and make contact decisions independently based on your needs and preferences.

Our Commitment to Dallas Homebuyers

At Oak Mortgage Group Directory, we're committed to maintaining high standards for the information we provide and the lenders we feature. This commitment manifests in several important ways that benefit Dallas homebuyers using our directory.

Accuracy and Currency

We strive to keep all directory information current and accurate. Lender contact information, service offerings, and specialties are regularly reviewed and updated. When mortgage regulations change, rate trends shift, or new programs become available, we update our educational content to reflect current conditions. While mortgage markets evolve constantly, we work diligently to ensure our directory remains a reliable, up-to-date resource.

Comprehensive Coverage

Our directory includes diverse lenders serving different segments of the Dallas market. We feature lenders specializing in conventional loans, FHA loans, VA loans, jumbo mortgages, renovation loans, and construction financing. We include large institutions and small boutique firms, ensuring coverage across the full spectrum of Dallas mortgage lending. This diversity ensures that regardless of your situation—excellent credit or challenged credit, substantial savings or minimal down payment, standard employment or self-employment—you can find lenders capable of serving you.

Educational Focus

We believe informed homebuyers make better decisions and achieve better outcomes. Our extensive educational content helps you understand mortgage basics, compare loan products, recognize fair practices, and avoid common mistakes. According to the Consumer Financial Protection Bureau, homebuyer education significantly improves outcomes and reduces default rates. We take this responsibility seriously, providing clear, comprehensive information that empowers Dallas homebuyers.

Objectivity and Transparency

We maintain objectivity in our directory by featuring multiple lenders in each category without playing favorites. We don't guarantee or endorse specific lenders—you should conduct your own due diligence, compare multiple lenders, and choose those best serving your needs. We encourage rate shopping, reading reviews, checking licenses, and asking questions before committing to lenders. Our role is facilitating connections and providing information, not making decisions for you.

Understanding the Dallas Mortgage Landscape

Dallas's mortgage market reflects the broader DFW metroplex's economic vitality and growth. Understanding this landscape helps you appreciate why selecting appropriate lenders matters and how our directory serves Dallas homebuyers.

Market Dynamics

The Dallas-Fort Worth metroplex encompasses multiple counties and hundreds of municipalities, creating diverse real estate submarkets with varying characteristics. Highland Park commands premium prices with excellent schools and established neighborhoods, while emerging areas like South Dallas offer affordability and revitalization potential. Property taxes vary by location but typically range from 2.0-2.5% of assessed values—among the nation's highest but funding excellent services and infrastructure.

Dallas's strong economy anchored by finance, technology, healthcare, and telecommunications creates steady housing demand. Major employers including AT&T, Bank of America, Texas Instruments, and numerous healthcare systems attract educated, well-compensated workers who drive housing demand across all price points. This economic strength supports healthy real estate appreciation, though Dallas remains more affordable than Austin, coastal California, or the Northeast.

Borrower Diversity

Dallas homebuyers represent diverse demographics and financial situations. First-time buyers—often young professionals relocating for careers—need guidance navigating mortgage processes and accessing assistance programs. Growing families trade up from starter homes to larger properties in good school districts. Empty nesters downsize from suburban homes to urban condos or active adult communities. Investors purchase rental properties throughout the metroplex. Each group has distinct financing needs requiring different lender expertise.

Dallas is home to substantial military and veteran populations thanks to nearby installations and VA medical facilities. These veterans deserve lenders who understand VA loans' unique benefits and requirements. The metroplex also has significant Hispanic and Asian populations, some preferring lenders offering services in their native languages. Our directory's diversity ensures all Dallas residents can find lenders capable of serving them effectively.

Regulatory Environment

Mortgage lending is heavily regulated at federal and state levels, protecting borrowers from predatory practices and ensuring fair lending standards. Texas has additional state-level regulations affecting mortgage lending, including specific provisions around home equity loans and refinancing. Reputable Dallas lenders maintain appropriate licenses, comply with regulations, and prioritize ethical practices. Our directory features licensed lenders operating legally within Texas and federal regulatory frameworks.

How to Use Our Directory Effectively

Maximizing value from Oak Mortgage Group Directory involves strategic use of our resources and thoughtful approaches to lender selection and comparison.

Start with Education

Before contacting lenders, explore our educational content to understand mortgage basics, loan types, qualification requirements, and current market conditions. Read our guides on topics relevant to your situation—comparing Dallas lenders, understanding FHA loans for low down payments, exploring VA benefits if you're military, or reviewing first-time buyer programs. This education helps you ask informed questions and recognize quality advice versus sales pitches.

Identify Your Needs

Consider your specific situation and priorities. Do you need low down payment options? Are you a veteran eligible for VA loans? Do you have excellent credit and substantial savings allowing competitive conventional financing? Are you self-employed requiring lenders experienced with complex income documentation? Do you prefer large institutions or personalized service from smaller lenders? Identifying priorities helps you focus on lenders best suited to your needs.

Compare Multiple Lenders

Contact at least three lenders from our directory, requesting loan estimates for identical scenarios. Compare interest rates, Annual Percentage Rates (APRs), closing costs, and customer service quality. Ask about their experience with your loan type, typical closing timelines, and references from recent Dallas clients. This comparison shopping ensures competitive terms and helps you identify lenders you're comfortable working with throughout mortgage processes.

Verify Credentials

While our directory features established lenders, conduct your own verification. Check lender licenses through the Nationwide Mortgage Licensing System (NMLS). Read online reviews on Google, Zillow, and the Better Business Bureau. Ask Dallas real estate agents about their experiences with specific lenders. This due diligence protects you and ensures you work with qualified, ethical professionals.

Stay Engaged Throughout the Process

Once you've selected a lender, remain actively involved throughout your mortgage process. Respond promptly to documentation requests, ask questions when confused, and communicate concerns immediately. The mortgage process involves many steps—from pre-approval through application, underwriting, appraisal, and closing—and your engagement helps ensure smooth transactions. Good lenders partner with you throughout these steps, but your participation remains essential.

Looking Forward: Growing with Dallas

As Dallas continues growing and evolving, Oak Mortgage Group Directory will grow alongside the market. We're committed to expanding our directory with additional quality lenders, updating content to reflect changing market conditions and regulations, and providing increasingly valuable resources to Dallas homebuyers.

We welcome feedback from Dallas homebuyers who use our directory. Your experiences, suggestions, and questions help us improve our resources and better serve the community. If you've worked with lenders in our directory, sharing your experiences helps future homebuyers make informed decisions. If you have suggestions for content topics or directory improvements, we want to hear from you.

The Dallas-Fort Worth metroplex offers tremendous opportunities for homebuyers willing to take the leap from renting to owning. With strong economic growth, diverse housing options at various price points, and numerous financing programs helping qualified buyers succeed, Dallas homeownership is achievable for many who might think it beyond reach. Oak Mortgage Group Directory exists to help you navigate the mortgage landscape successfully, connecting you with lenders who can make your Dallas homeownership dreams reality.

Contact Us

Oak Mortgage Group Directory is here to support your Dallas homebuying journey. While we provide directory services rather than direct lending, we're available to answer questions about using our directory, understanding mortgage options, or finding appropriate lenders for your specific needs.

You can reach us at:

- Phone: (214) 366-2104

- Email: contact@oakmortgagegroup.com

- Address: 3090 Nowitzki Way Suite 300, Dallas, TX 75219

We typically respond to inquiries within one business day. Whether you're just beginning to explore Dallas homeownership possibilities or you're actively shopping for lenders, we're here to help guide you toward appropriate resources.

Thank you for choosing Oak Mortgage Group Directory as your resource for finding Dallas mortgage lenders. We wish you success in your homeownership journey and look forward to serving the Dallas community for years to come.